As we venture into the exciting world of cryptocurrency mining, the potential return on investment (ROI) for mining rigs, particularly given the landscape of ever-changing electricity costs and mining difficulty, looms larger than ever. By 2025, the dynamics surrounding Bitcoin and other cryptocurrencies will play a crucial role in determining how miners strategize around their operations.

Cryptocurrency mining is the backbone of many networks, where specialized equipment—the mining rig—solves complex algorithms to validate transactions. However, without careful consideration of operational costs, particularly electricity, miners may find their profitability eroding rapidly. As energy prices fluctuate and mining difficulty continues to escalate, understanding these variables becomes paramount for anyone eager to jump into or remain within the mining ecosystem.

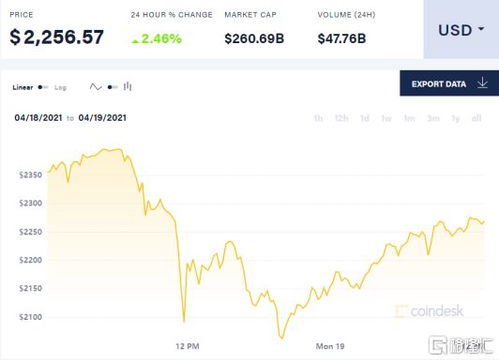

The two principal cryptocurrencies that dominate the market, Bitcoin (BTC) and Ethereum (ETH), often set the stage for mining profitability. With Bitcoin’s impending halving event and Ethereum’s transition to proof-of-stake, miners must weigh potential outcomes critically. The ongoing battle between maintaining energy efficiency and maximizing output dictates long-term strategies and short-term decisions alike.

In 2025, the unpredictability associated with electricity rates will significantly shape the landscape. Miners utilizing hosting services may gain an edge, particularly if those facilities deploy renewable energy sources or have negotiated fixed-rate contracts. Optimizing for lower energy consumption will leverage both hardware efficiency and innovative cooling technologies, further augmenting ROI. With the increasing prominence of mining farms—large-scale operations—efficiencies will only magnify, as collective bargaining and resource-sharing capabilities come into play.

Another factor to consider is the evolving complexity of consensus algorithms. As mining difficulty increases for major cryptocurrencies, miners will need to equip themselves with advanced machinery capable of tackling high-stakes challenges. The demand for powerful mining rigs has led to fierce competition, causing prices to surge. Therefore, understanding the nuances of hardware specifications, such as hash rate and energy output, becomes essential for miners. Evaluating these metrics can lead to astute investments in mining hardware, whether for personal use or through hosting agreements.

The altcoins, including Dogecoin (DOGE), present contrasting narratives. Though often regarded as meme cryptocurrencies, their communities rally together, continually pushing for increased credibility and technological improvements. Such a phenomenon hints at the importance of diversification in a miner’s portfolio, where profits from more stable assets can support ventures into more speculative coins. A shrewd miner will weigh the potential of various cryptocurrencies against ongoing operational costs, ultimately making decisions that ensure a healthy balance between risk and reward.

Mining farms now encompass the latest in technological advancements—such as immersion cooling and containerized mining setups—enabling operators to scale efficiently. However, profitability remains tethered to a delicate interplay of external factors, including market trends and regulatory measures. As we inch toward 2025, these externalities will undoubtedly place miners on a rollercoaster of financial fluctuations, making robust financial modeling a necessity.

What’s crystal clear is that aspiring miners cannot rely solely on speculative price increases to secure profits; instead, they must formulate comprehensive strategies that include energy management, hardware upgrades, and potential market shifts. With a growing number of exchanges available for trading cryptocurrencies, incorporating arbitrage opportunities into the mix can also provide value. Ultimately, factors like exchange fees and transaction times must be considered to refine profit margins.

Lastly, as technological advancements continue to unfold, we are likely to witness new paradigms in mining operations. Innovations in artificial intelligence and machine learning may pave the way for smarter mining rigs capable of self-optimizing for various conditions and alerting operators to inefficiencies. In such an environment, harnessing data analytics effectively will be crucial in navigating the competitive landscape of mining, allowing miners to adapt on the fly, precisely when they need it most.

In conclusion, navigating the complex terrain of mining rig ROI by 2025 requires a multi-faceted approach, balancing the intricacies of energy costs, mining difficulty, and the ever-evolving cryptocurrency market. By leaning into innovations and remaining adaptable, miners can maximize their chances of reaping plentiful rewards, despite the unpredictability that lies ahead.

Leave a Reply